Meta Description: Jerome Powell’s Federal Reserve policies have a profound impact on global markets. Analyse how the Fed Chair’s monetary decisions impact India, emerging economies, and international financial stability in 2025.

Introduction

Jerome Powell, standing in the esteemed halls of the Federal Reserve building in Washington, D.C., holds a position of unparalleled influence in global economic decision-making. As the 16th Chair of the Federal Reserve, his every word resonates through financial markets from Wall Street to Dalal Street, significantly impacting millions of lives across continents. His role, unique and unprecedented, has never been more pronounced.

Recent data reveal a concerning reality: Powell confirmed that the Fed would have cut interest rates by now if not for tariff-induced inflationary pressures. This admission, made during the Federal Open Market Committee’s recent meeting, signals a fundamental shift in global monetary policy that extends far beyond American borders. For India, with its $4 trillion economy increasingly integrated into global supply chains, Powell’s decisions at the Fed represent both unprecedented opportunity and existential risk. However, with strategic planning and proactive measures, India can mitigate these adverse effects, underscoring the importance of understanding its policies and implementing effective measures.

Consider this compelling statistic: when the Federal Reserve adjusts interest rates by just 25 basis points, emerging market economies collectively experience capital flow reversals worth $20 billion to $ 40 billion within weeks. As India navigates its path toward becoming a $7 trillion economy by 2030, understanding and adapting to Jerome Powell’s Federal Reserve policies isn’t just an academic exercise – it’s a call to immediate action for economic survival, highlighting the urgency for India to comprehend and adapt to these policies.

Jerome Powell’s Federal Reserve: The Man Behind Global Monetary Policy

The Chair’s Background and Philosophy

Jerome Hayden “Jay” Powell, born February 4, 1953, brings a unique blend of investment banking experience and legal expertise to his role as Chair of the Federal Reserve, a position he has held since 2018. His background as a former partner at the Carlyle Group and his brief stint as Under Secretary of the Treasury provide him with insights into both private markets and government policy. This combination has shaped his pragmatic approach to monetary policy.

Powell’s leadership philosophy, which centres on data-driven decision making and clear communication, is of utmost importance. However, recent political pressures have tested these principles. Trump has expressed strong disapproval of the Fed’s maintenance of higher interest rates, even posting on Truth Social that “Powell’s termination cannot come fast enough!” Legal scholars maintain that a sitting Fed Chair cannot be removed without cause.

This political tension creates unprecedented uncertainty for global markets, particularly affecting countries like India that depend on stable American monetary policy for their own economic planning. The potential impact of Powell’s policies on India’s economic planning underscores the need for stability in American monetary policy.

Current Policy Framework and Global Implications

Under Powell’s leadership, the Federal Reserve operates with a dual mandate: achieving maximum employment and maintaining price stability through a 2% inflation target. However, Powell acknowledges that the new Administration is implementing substantial policy changes in trade, immigration, fiscal policy, and regulation, with effects on the economy remaining highly uncertain.

The Fed’s current policy stance reflects this uncertainty:

• Interest Rate Policy: The Federal Open Market Committee’s dot plot projections indicate there could be two rate cuts by the end of 2025, though Powell maintains the Fed is “well positioned” to remain in a wait-and-see mode

• Inflation Management: Powell reports the economy shows solid growth with a labour market in balance and inflation running closer to, but still above, the 2% objective

• Trade Policy Response: Powell warns that tariffs will likely cause higher inflation and slower growth, creating more economic disruption than initially expected

Global Economic Reverberations: When America Sneezes, The World Catches Cold

Emerging Market Vulnerabilities

Jerome Powell’s Federal Reserve policies have a cascading effect across emerging economies through multiple transmission channels. The most immediate impact occurs through capital flows, where even minor changes in Fed policy trigger massive portfolio adjustments by international investors.

Recent analysis shows that emerging markets face particularly acute challenges:

Capital Flow Volatility: When the Fed maintains higher rates to combat tariff-induced inflation, it creates a ‘gravitational pull’ effect. This effect, a metaphor for the attraction of capital to higher-yielding assets, draws investment capital back to dollar-denominated assets. This phenomenon has already begun materialising, with emerging market bond funds experiencing net outflows of $15-20 billion monthly since Powell’s hawkish stance became apparent.

Currency Pressure: The strengthening dollar, driven by higher Fed rates, creates debt servicing challenges for countries with significant dollar-denominated borrowings. For nations like India, Brazil, and Indonesia, this translates to higher costs for importing essential goods and servicing external debt.

Monetary Policy Constraints: Emerging market central banks find themselves in an impossible position – they must choose between matching Fed rate increases to prevent capital flight or cutting rates to support domestic growth. This ‘impossible trinity’, a concept in international economics, refers to the idea that a country cannot simultaneously have an independent monetary policy, a fixed exchange rate, and free capital movement. This dilemma has historically led to economic crises in developing nations.

Trade Finance and Global Commerce Disruption

Powell’s Fed policies intersect dangerously with global trade tensions, creating compound effects that threaten international commerce. Powell has ruled out preemptive rate cuts to mitigate the impacts of tariffs, signalling that monetary policy will not be used to offset the consequences of the trade war.

This approach creates several problems for global trade:

• Increased Transaction Costs: Higher U.S. interest rates make trade finance more expensive, particularly affecting smaller exporters in developing countries.

• Supply Chain Disruption: Uncertainty about Fed policy duration makes long-term supply chain investments riskier

• Competitive Devaluation Risks: Other central banks may be forced into aggressive easing to maintain export competitiveness

Financial Market Integration Under Stress

Global financial markets have become increasingly interconnected over the past two decades, making the Fed’s decisions, such as those by Powell, critically crucial for worldwide stability. The current environment presents unique challenges:

Cross-Border Banking: Major international banks with significant exposure to both U.S. and emerging markets face competing pressures from Fed policy and local economic conditions.

Sovereign Debt Markets: Emerging market government bonds have become increasingly correlated with expectations of Fed policy, creating vulnerability to sudden shifts in policy.

Corporate Funding: Multinational corporations, particularly those from emerging markets, face higher borrowing costs and reduced access to international capital markets.

India’s Economic Crossroads: Navigating Fed Policy Spillovers

The Technology Sector’s American Dependencies

India’s $200 billion information technology sector faces unprecedented challenges from Jerome Powell’s Federal Reserve policies, compounded by broader U.S. policy shifts. The Sector’s heavy reliance on American clients and H-1B visa programs creates multiple vulnerability points.

India’s third-quarter GDP growth of 6.2% year-over-year, coupled with IMF projections of 6.2% growth for fiscal 2025-2026, sparked initial concerns about economic momentum. However, deeper analysis reveals that much of this growth depends on sustained demand for Indian IT services, which faces pressure from Fed policy through several channels:

Client Budget Constraints: Higher interest rates in the U.S. are forcing American companies to reduce their technology spending, which directly impacts the revenue growth of Indian IT firms. Major contracts worth $50-100 million face delay or cancellation as clients prioritise cost reduction.

Currency Impact on Contracts: The strengthening dollar, driven by Fed policy, creates both opportunities and risks for Indian IT companies. While dollar revenues translate to higher rupee earnings, long-term contracts become harder to price accurately amid currency volatility.

Talent Mobility Challenges: Restricted H-1B policies, combined with higher U.S. borrowing costs, make it more expensive for Indian companies to maintain on-site operations, forcing costly operational restructuring.

Manufacturing and Export Sector Implications

India’s ambitious manufacturing expansion faces headwinds from the Fed’s policies under Powell, which extend beyond direct monetary effects. The “Make in India” initiative, aimed at increasing manufacturing’s share of GDP from 16% to 25%, encounters several Fed-related obstacles:

Raw Material Cost Pressures: Higher global interest rates increase the cost of commodity financing, making raw materials more expensive for Indian manufacturers. Steel, petroleum products, and electronic components – all critical for manufacturing – are experiencing price volatility linked to expectations of Fed policy.

Export Competitiveness: 2025 marks a pivotal year for India’s economic aspirations, representing the midpoint in achieving the UN Sustainable Development Goals. However, Fed-induced dollar strength makes Indian exports more expensive in international markets, potentially undermining competitiveness gains achieved through domestic reforms.

Foreign Direct Investment: Manufacturing FDI, crucial for technology transfer and job creation, faces headwinds as global investors rebalance portfolios toward higher-yielding U.S. assets.

Financial Sector Stability Concerns

India’s banking system, which has been strengthened significantly since the 2018 crisis, now faces new challenges from the spillovers of Fed policy. The Reserve Bank of India must navigate a delicate balance between supporting domestic growth and maintaining financial stability amid external pressures.

Corporate Debt Refinancing: Indian companies with dollar-denominated debt face higher refinancing costs, potentially creating stress for sectors such as power, telecom, and infrastructure that borrowed heavily during the low-interest-rate environment of 2020-2022.

Banking Sector Capital: Higher global rates reduce the attractiveness of Indian bank stocks to foreign investors, potentially constraining capital raising for expansion. This is particularly concerning as banks need additional capital to support India’s growth aspirations.

Foreign Portfolio Investment: Equity markets face dual pressures from Fed policy, both through direct capital flows and indirect effects on corporate earnings. The Sensex and Nifty have shown increased correlation with Fed policy expectations, reducing the independence of Indian monetary policy.

Central Bank Independence: A Global Democratic Institution Under Siege

The Precedent Danger

Jerome Powell’s confrontation with political pressure represents more than American domestic politics – it threatens the fundamental principle of central bank independence that has anchored global monetary stability since the 1970s. Prominent economist Mohamed El-Erian suggests Powell should consider resignation to preserve Fed independence, stating, “We are nowhere near the world of first bests”.

This erosion of central bank independence creates dangerous precedents worldwide:

Emerging Market Contagion: If the Federal Reserve, the world’s most respected central bank, succumbs to political pressure, it provides justification for authoritarian leaders to interfere with their own monetary institutions. Countries like Turkey, Argentina, and Venezuela have already experienced economic disasters from politicised monetary policy.

International Coordination Breakdown: Global Crisis Response Depends on Central Bank Cooperation. The 2008 financial crisis and the COVID-19 pandemic demonstrated the power of coordinated monetary policy. Political interference threatens this cooperation by making central bank commitments less credible.

Long-term Credibility Costs: Even if Powell successfully resists political pressure, the mere existence of such pressure still damages the Fed’s credibility. Market participants begin pricing in political risk, making monetary policy less effective and potentially destabilising.

Implications for India’s Monetary Sovereignty

The Reserve Bank of India has worked for decades to establish independence and credibility. RBI’s ability to conduct effective monetary policy depends partly on global acceptance of central bank independence norms. If these norms erode in the United States, they become vulnerable everywhere.

Historical context matters: India experienced political interference with RBI policy during the 1970s and early 1980s, contributing to persistent inflation and economic instability. The hard-won independence achieved through reforms in the 1990s and 2000s could face renewed challenges if global norms shift.

Policy Transmission Mechanisms: RBI’s ability to influence economic activity through interest rates depends on credible commitment to price stability. Political interference, whether domestic or inspired by American precedents, could undermine this credibility.

International Market Access: Indian government and corporate borrowers benefit from the RBI’s credible monetary policy framework. Erosion of central bank independence could lead to higher borrowing costs by increasing risk premiums.

Economic Data Analysis: Quantifying Global Risks

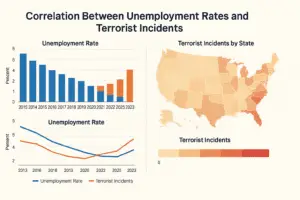

Interest Rate Transmission and Capital Flow Modelling

Recent economic analysis reveals alarming patterns in how changes in Federal Reserve policy are transmitted to emerging markets. Historical data from 2013’s “taper tantrum” and 2018’s emerging market crisis provide baseline models for current risks:

Capital Flow Sensitivity: Empirical analysis indicates that a 100-basis-point increase in Fed rates typically triggers $75-$ 100 billion in portfolio outflows from emerging markets within six months. The current Fed policy trajectory suggests that cumulative outflows could reach $200-300 billion by the end of 2025.

Exchange Rate Impact: Currency depreciation generally follows predictable patterns in response to changes in Fed policy. For the Indian Rupee, historical correlations suggest a 15-20% volatility range during periods of Fed policy uncertainty, compared to the standard 5-8% range.

Growth Impact Calculations: IMF models indicate that sustained Fed rate increases above 5% typically reduce emerging market growth by 1.5-2.0 percentage points annually through various transmission channels. For India, this could mean growth falling from the projected 6.2% to 4.5-5.0%.

Trade and Investment Flow Analysis

The intersection of Fed policy with global trade creates measurable economic impacts:

Trade Finance Costs: Global trade finance rates have increased by 200-300 basis points since Fed hawkishness became apparent. For Indian exporters, this translates to $5-10 billion in additional annual financing costs.

Foreign Direct Investment: FDI flows to emerging markets exhibit a strong negative correlation with the Fed’s interest rate levels. India, which attracted $83 billion in FDI during fiscal 2023-24, could see inflows decline to $60-70 billion under sustained high Fed rates.

Remittance Effects: Higher U.S. interest rates typically reduce remittance flows as diaspora communities face higher borrowing costs and economic pressure. India’s $125 billion annual remittance inflows could decline by 10-15% if the Fed’s prolonged tightening persists.

Sectoral Impact Quantification

Different sectors of the Indian economy show varying sensitivity to Fed policy changes:

Information Technology: A revenue correlation analysis reveals that 70-80% of the Indian IT sector’s performance depends on U.S. economic conditions. Fed-induced slowdown could reduce sector growth from 8-10% annually to 3-5%.

Pharmaceuticals: Generic drug exports to the U.S. market face pricing pressure when Fed policy strengthens the dollar. Industry analysis suggests that revenue declines of 5-10% are possible under sustained dollar strength.

Textiles and Manufacturing: Export-oriented manufacturing exhibits high sensitivity to exchange rate fluctuations driven by Federal Reserve policy. A 10% rupee depreciation typically improves export competitiveness but increases raw material costs, creating mixed sectoral impacts.

Regional Economic Integration Under Threat

ASEAN and South Asian Coordination Challenges

Jerome Powell’s Fed policies create particular challenges for regional economic integration efforts in Asia. The Association of Southeast Asian Nations (ASEAN) and the South Asian Association for Regional Cooperation (SAARC) face disruption of carefully constructed financial cooperation mechanisms.

Currency Swap Arrangements: Regional currency swap agreements, designed to provide liquidity during crises, become less effective when Fed policy creates systematic stress across all participating countries simultaneously.

Trade Settlement Systems: Efforts to reduce dollar dependence in regional trade face setbacks when Fed policy makes dollar financing more attractive relative to local currency alternatives.

Investment Coordination: Regional development banks and investment funds face capital constraints when Fed policy triggers investor flight to dollar assets.

China’s Strategic Response and Implications

China’s potential response to Fed policy tightening represents the most significant risk to global economic stability. Historical precedent suggests China may respond to U.S. monetary pressure through several channels:

Monetary Policy Divergence: The People’s Bank of China could pursue aggressive easing to offset the effects of Fed tightening, creating competitive devaluation pressures across Asia.

Trade Finance Alternatives: China might accelerate the development of yuan-denominated trade financing systems, potentially fragmenting global commerce into competing currency blocs.

Regional Financial Architecture: The expansion of institutions like the Asian Infrastructure Investment Bank could provide alternatives to dollar-based financing, thereby reducing the influence of American monetary policy.

For India, these developments create both opportunities and risks. A reduced Chinese economic influence could benefit Indian manufacturers and service providers; however, financial system fragmentation could increase transaction costs and reduce efficiency.

Solutions and Mitigation Strategies: Building Resilience

For India: Comprehensive Defence Mechanisms

Indian policymakers must implement multi-layered strategies to protect against Fed policy spillovers while maintaining growth momentum:

Monetary Policy Coordination: The Reserve Bank of India should strengthen its bilateral relationships with other emerging market central banks to coordinate responses to shocks in Federal Reserve policy. This includes expanding the network of currency swap agreements beyond the current $75 billion committed under various arrangements.

Fiscal Policy Flexibility: The Indian government must maintain fiscal discipline to provide countercyclical capacity during external shocks. Current budgetary deficit targets of 4.5% of GDP give some room for stimulus, but additional consolidation would enhance crisis response capability.

Financial Sector Strengthening: Banking regulations should be enhanced to ensure adequate capital buffers for external shocks. Stress testing scenarios should include Fed policy tightening combined with global trade disruptions.

External Sector Management: Foreign exchange reserves, currently valued at around $650 billion, provide a substantial buffer capacity. However, strategic reserves management should focus on maintaining adequate liquidity across multiple currency denominations.

Economic Diversification: Reducing dependence on any single export market or financing source requires accelerated development of domestic consumption and regional trade relationships.

Global Institutional Reforms

The international community must also consider systemic reforms to reduce vulnerability to single-country monetary policy disruptions:

Enhanced IMF Capabilities: The International Monetary Fund requires expanded resources and more flexible lending mechanisms to respond quickly to the effects of Federal Reserve policy spillovers. The current IMF lending capacity of approximately $1 trillion may prove inadequate during systemic stress in emerging markets.

Regional Financial Institution Development: Emerging economies should accelerate the development of alternative financial institutions, such as the New Development Bank and the Asian Infrastructure Investment Bank, as well as various regional development banks.

Payment System Diversification: The development of alternative international payment systems that reduce dollar dependence could provide insulation from Federal Reserve policy volatility. However, such systems must maintain efficiency and security standards.

Central Bank Communication Standards: International agreements establishing minimum standards for central bank independence and communication could help prevent the spread of monetary policy politicisation.

Technology and Innovation: Adapting to New Realities

Digital Financial Infrastructure

Fed policy volatility could accelerate the adoption of financial technologies that reduce dependence on traditional monetary policy transmission mechanisms:

Central Bank Digital Currencies: India’s digital rupee pilot program could be expanded to provide alternative payment and settlement mechanisms for international trade, reducing exposure to dollar financing costs.

Blockchain-Based Trade Finance: Distributed ledger technologies could reduce the cost and complexity of international trade financing, making businesses less dependent on traditional banking relationships that are influenced by Federal Reserve policy.

Artificial Intelligence Risk Management: Advanced analytics could help Indian businesses better predict and hedge against Fed policy-induced volatility in exchange rates, commodity prices, and financing costs.

Innovation in Economic Policy

Emerging technologies also offer new tools for economic policy management:

Real-time Economic Monitoring: Enhanced data collection and analysis capabilities could provide earlier warning of Fed policy spillovers, enabling more rapid policy responses.

Dynamic Hedging Strategies: Sophisticated financial instruments could help businesses and governments manage exposure to Fed policy volatility without altogether avoiding international markets.

Alternative Investment Mechanisms: New financing structures could reduce dependence on traditional international capital markets, which are influenced by changes in Federal Reserve policy.

Long-term Structural Implications: Reshaping Global Economics

The Dollar’s Reserve Currency Evolution

Jerome Powell’s Fed policies occur within the context of longer-term questions about the dollar’s role as the world’s primary reserve currency. While this role won’t disappear quickly, current tensions could accelerate gradual shifts:

Gradual Diversification: Central banks worldwide have slowly reduced dollar reserves from 72% of global totals in 2000 to approximately 60% today. Fed politicisation could accelerate this trend.

Regional Currency Zones: The development of regional payment and settlement systems could reduce dollar dependence for specific trade relationships, although global dollar dominance would likely persist.

Digital Currency Competition: Central bank digital currencies and private digital assets could eventually challenge the dominance of the dollar, although significant technological and regulatory hurdles remain.

For India, these changes create both opportunities and challenges. Reduced dollar dominance might provide greater monetary policy independence, but transition periods typically involve increased volatility and uncertainty.

Global Economic Governance Evolution

Current tensions around Fed policy highlight broader questions about global economic governance in a multipolar world:

Institutional Reform Needs: Existing institutions, such as the IMF, World Bank, and G20, may require restructuring to reflect changing economic power distributions and address new challenges.

Sovereignty vs. Integration: Countries must strike a balance between the benefits of international economic integration and the need to maintain domestic policy autonomy.

Crisis Prevention Mechanisms: New institutions and mechanisms may be necessary to prevent and manage crises arising from conflicts between major economic powers.

Conclusion: Navigating Uncertainty with Strategic Wisdom

Jerome Powell’s leadership of the Federal Reserve occurs at a critical juncture in global economic history. His decisions reverberate through every corner of the international financial system, affecting billions of lives from Silicon Valley to the Silicon Valley of India in Bangalore. The current environment of political pressure, trade tensions, and monetary policy uncertainty creates unprecedented challenges that require coordinated global responses.

For India, the stakes could not be higher. With GDP growth at 6.2% and the IMF projecting similar levels for 2025-2026, the country stands at a critical economic inflexion point. Whether India can achieve its aspirations of becoming a $7 trillion economy by 2030 depends significantly on how well it navigates the turbulent waters created by Fed policy uncertainty and global economic fragmentation.

The data is unmistakable: Fed policy spillovers pose measurable risks to the growth, financial stability, and development progress of emerging markets. Capital flow reversals, currency volatility, and trade finance disruptions represent clear and present dangers to India’s economic trajectory. Yet within these challenges lie opportunities for those prepared to act strategically.

The path forward requires both defensive preparations and offensive positioning. India must strengthen its financial buffers, diversify its economic relationships, and build resilient institutions while simultaneously pursuing growth opportunities created by global economic restructuring. This dual approach – protecting against downside risks while positioning for upside opportunities – represents the essence of strategic economic policy in an uncertain world.

Most importantly, India and other emerging economies must recognise that Jerome Powell’s Fed policies are not merely American domestic issues – they are global challenges requiring coordinated global solutions. The interconnected nature of modern economics means that no country, regardless of size or economic sophistication, can completely insulate itself from Fed policy spillovers.

The time for complacency has passed. As political pressures mount on Fed independence and global economic tensions escalate, every day brings new challenges to the post-World War II economic order that has enabled unprecedented global prosperity. India’s leaders – in government, business, and civil society – must engage actively in international efforts to maintain economic stability while preparing comprehensive defensive measures for potential disruptions.

History will judge how well the global community navigated this period of monetary policy uncertainty and institutional stress. For India, success means not just surviving the turbulence created by Jerome Powell’s Federal Reserve policies, but emerging stronger and more resilient on the other side. The choices made in the coming months will determine whether the global economy emerges from this period with renewed stability and prosperity or fragments into competing blocs, reducing living standards for billions of people worldwide.

The stakes are clear, the risks are measurable, and the time for action is now. Jerome Powell’s Federal Reserve may be an American institution, but its policies are a global responsibility. India must rise to meet this challenge with the strategic wisdom and coordinated action that this critical moment demands.

Hey, I stumbled upon 7j777 the other day. Nothing too fancy, but worth a look if you’re bored. Here’s the link: 7j777

Betvn01…hmmm. I’d say it’s decent. Nothing mind-blowing, but definitely reliable. Good odds on the sports betting side of things. Could use a visual upgrade, but it gets the job done: betvn01

Hey, checked out sssgames and they had a fairly wide selection of games. I found games I enjoyed. It’s a good place to chill and spend some time. Games for days!

Been messing around on jiliwin3. I really enjoy this platform, good selection on games. Im hooked. See for yourself: jiliwin3

Tried ktslots1 the other day. Pretty standard stuff, you know? Some familiar titles. Might be worth a spin if you’re after something simple. Check them out at ktslots1.

Heard about kk88win from a friend. Says it’s pretty decent. Might give it a try this week. Anyone else play there? What are your thoughts? kk88win

Heard rumors about ngonclub. Something about it being new and having pretty good promotions. Thinking about checking it out to find a new place to spend some time. ngonclub

Anyone have any experience with gowinclub? I see it advertised all over the place. Is it worth the hype or is it just another scam? gowinclub