Introduction

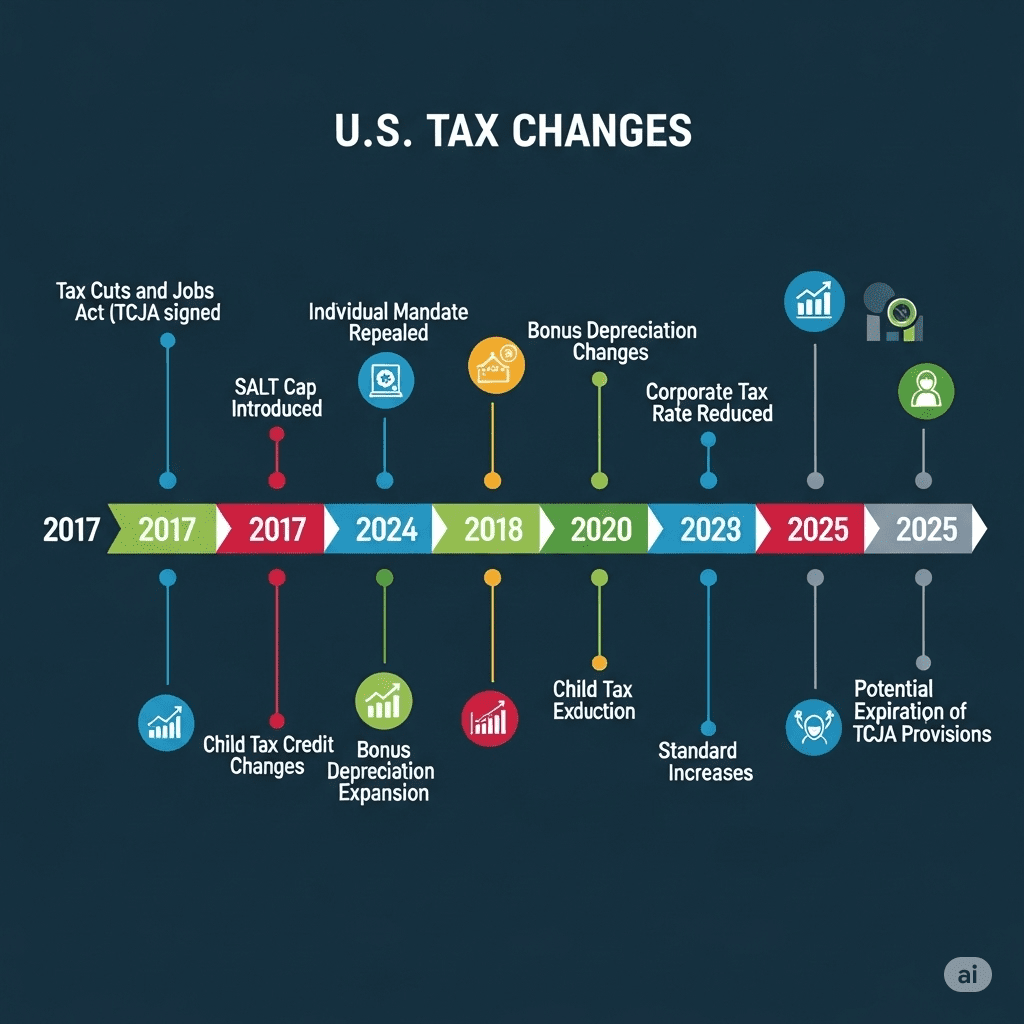

The Tax Cuts and Jobs Act (TCJA) continues to shape American taxpayers’ financial obligations in 2025, with several key provisions remaining in effect while others face potential expiration. Recent data from the Internal Revenue Service indicates that approximately 150 million taxpayers will file returns under modified tax regulations this year, with 78% experiencing different tax calculations compared to pre-2018 rules.

Understanding these ongoing changes becomes crucial as taxpayers prepare their 2025 returns. The legislation’s complex provisions affect everything from standard deductions to itemized write-offs, creating significant implications for tax planning strategies. Current analysis suggests that middle-income families continue to see the most substantial impacts, though effects vary considerably based on individual circumstances.

The evolving nature of tax policy implementation means that taxpayers must navigate both established changes and recent modifications to maximize their tax efficiency while ensuring compliance with current regulations.

Standard Deduction Changes for 2025

The standard deduction amounts for 2025 reflect continued inflation adjustments built into the TCJA framework. Single filers can claim a standard deduction of $14,600, representing a $750 increase from 2024 levels. Married couples filing jointly qualify for a $29,200 standard deduction, while heads of household receive $21,900.

These enhanced standard deduction amounts continue to benefit approximately 90% of taxpayers who choose not to itemize deductions. The increased thresholds particularly impact middle-income families who previously itemized but now find the standard deduction more advantageous.

Key implications include:

- Simplified tax preparation for most filers

- Reduced benefit from charitable contributions below standard deduction thresholds

- Elimination of miscellaneous itemized deductions subject to 2% AGI floor

- Enhanced tax efficiency for taxpayers with moderate mortgage interest and state tax obligations

- Continued pressure on tax preparation industry due to simplified filing requirements

The inflation adjustments ensure that standard deduction benefits maintain purchasing power, though some taxpayers in high-cost areas continue to face challenges with the state and local tax deduction limitations.

Individual Tax Bracket Modifications

The 2025 tax brackets maintain the seven-tier structure established under the TCJA, with inflation-adjusted income thresholds that affect millions of taxpayers. The marginal tax rates remain at 10%, 12%, 22%, 24%, 32%, 35%, and 37% for different income levels.

For single filers, the brackets break down as follows:

- 10% on income up to $11,600

- 12% on income from $11,601 to $47,150

- 22% on income from $47,151 to $100,525

- 24% on income from $100,526 to $191,050

- 32% on income from $191,051 to $243,725

- 35% on income from $243,726 to $609,350

- 37% on income over $609,350

Married couples filing jointly benefit from roughly doubled thresholds, while heads of household fall between single and joint filer amounts. These bracket adjustments generally result in lower effective tax rates compared to pre-TCJA levels, particularly for middle and upper-middle income taxpayers.

The bracket structure continues to provide the most significant benefits to taxpayers earning between $50,000 and $200,000 annually, while high-income earners see moderate reductions and lower-income taxpayers experience minimal changes due to existing low rates and credits.

State and Local Tax Deduction Limitations

The $10,000 cap on state and local tax (SALT) deductions remains one of the most controversial aspects of the TCJA, significantly affecting taxpayers in high-tax states. This limitation applies to the combined total of property taxes, state income taxes, and local taxes, creating substantial impacts for homeowners in states like California, New York, and New Jersey.

Analysis of 2024 filing data reveals that approximately 13.1 million taxpayers reached the SALT deduction cap, with the average capped amount exceeding $18,500. The limitation particularly affects:

- Homeowners with properties valued above $400,000

- High-income earners in states with progressive income tax structures

- Taxpayers in metropolitan areas with elevated local tax rates

- Married couples filing separately who face a $5,000 SALT cap each

Several states implemented workarounds, including employer-side payroll taxes and charitable contribution credits, though IRS guidance limited the effectiveness of some strategies. The limitation forces many previously itemizing taxpayers to claim the standard deduction instead.

Geographic analysis shows the most significant impacts concentrated in counties with median home values exceeding $350,000 and state income tax rates above 5%, creating regional disparities in tax burden distribution.

Mortgage Interest Deduction Changes

The TCJA modified mortgage interest deduction rules, limiting the deduction to interest paid on acquisition debt up to $750,000 for mortgages originated after December 15, 2017. Existing mortgages with higher debt amounts maintain grandfathered status under previous $1 million limits.

Current impacts include:

- Reduced deduction benefits for high-value home purchases

- Elimination of home equity loan interest deductions unless funds were used for home improvements

- Continued full deductibility for most homeowners with mortgage balances below $750,000

- Regional variations in impact based on local housing market prices

- Simplified calculation requirements for most taxpayers

Real estate market analysis indicates that approximately 8% of new mortgage originations exceed the $750,000 threshold, primarily in coastal metropolitan areas. The changes create incentives for smaller mortgage amounts and larger down payments among affected buyers.

The elimination of home equity loan interest deductions affects an estimated 2.3 million taxpayers annually, though the impact varies significantly based on loan purposes and amounts.

Child Tax Credit Provisions

The enhanced Child Tax Credit remains at $2,000 per qualifying child under age 17, with up to $1,600 refundable for taxpayers with insufficient tax liability. The credit phases out for adjusted gross income exceeding $200,000 for single filers and $400,000 for married couples filing jointly.

Additional provisions include:

- $500 credit for qualifying dependents who don’t meet child tax credit requirements

- Enhanced income thresholds compared to pre-TCJA levels

- Simplified qualification requirements for most families

- Coordination with other family-related tax benefits

- Continued Social Security number requirements for credit eligibility

The credit expansion benefits approximately 40 million families annually, with the refundable portion providing particular assistance to lower-income working families. The higher phase-out thresholds ensure that middle and upper-middle income families retain credit benefits.

Analysis indicates that families with multiple children see the most substantial benefits, while single-child families experience moderate improvements compared to previous tax law provisions.

Business Tax Deduction Changes

The Section 199A qualified business income deduction allows eligible taxpayers to deduct up to 20% of qualified business income from partnerships, S corporations, sole proprietorships, and some trusts. The deduction applies to taxable income below $191,050 for single filers and $382,100 for married couples filing jointly in 2025.

Key requirements and limitations:

- W-2 wage and depreciable property limitations for high-income taxpayers

- Specified service trade or business restrictions above income thresholds

- Complex calculation requirements for mixed-activity businesses

- Coordination with other business deductions and credits

- Documentation requirements for deduction substantiation

Approximately 23 million taxpayers claimed the Section 199A deduction in recent filing years, with average deduction amounts of $8,400. The provision particularly benefits:

- Small business owners with pass-through entity structures

- Real estate investors and developers

- Independent contractors and freelancers

- Professional service providers below income thresholds

- Taxpayers with multiple business income sources

The deduction’s complexity requires careful tax planning and often professional preparation assistance, particularly for taxpayers near income thresholds or with multiple business activities.

Alternative Minimum Tax Modifications

The TCJA significantly reduced Alternative Minimum Tax (AMT) impact by increasing exemption amounts and phase-out thresholds. For 2025, AMT exemptions are $85,700 for single filers and $133,300 for married couples filing jointly, with phase-out beginning at $609,350 and $1,218,700 respectively.

These changes result in:

- Dramatic reduction in taxpayers subject to AMT

- Elimination of AMT for most middle and upper-middle income families

- Continued AMT applicability for very high-income taxpayers

- Simplified tax calculation for previously affected taxpayers

- Reduced complexity in tax planning strategies

Current estimates suggest fewer than 500,000 taxpayers will owe AMT in 2025, compared to approximately 5 million under previous law. The reduction particularly benefits taxpayers in high-tax states who previously faced AMT due to large state and local tax deductions.

The changes eliminate AMT considerations for most tax planning decisions, though high-income taxpayers with significant preference items must continue monitoring potential AMT liability.

Itemized Deduction Modifications

Several itemized deductions faced elimination or modification under the TCJA, affecting taxpayers who continue to itemize rather than claim the standard deduction. The most significant changes include:

Eliminated Deductions:

- Miscellaneous itemized deductions subject to 2% AGI threshold

- Tax preparation fees and investment advisory fees

- Unreimbursed employee business expenses

- Moving expenses (except military)

- Casualty and theft losses (except federally declared disasters)

Modified Deductions:

- State and local tax deduction capped at $10,000

- Mortgage interest limited to $750,000 acquisition debt

- Charitable contributions maintained with enhanced limits

- Medical expense deduction threshold reduced to 7.5% of AGI

These modifications particularly impact:

- High-income professionals with significant unreimbursed business expenses

- Taxpayers in high-tax states with substantial property tax obligations

- Investors with advisory fees and other investment-related expenses

- Employees with job-related expenses not reimbursed by employers

The changes encourage employer reimbursement arrangements and affect tax planning strategies for affected taxpayers.

Estate and Gift Tax Adjustments

The TCJA doubled the federal estate and gift tax exemption to $13.61 million per individual in 2025, adjusted annually for inflation. This enhancement significantly reduces the number of estates subject to federal estate tax while maintaining the 40% tax rate on amounts exceeding the exemption.

Current implications include:

- Fewer than 2,000 estates annually subject to federal estate tax

- Enhanced gift-giving opportunities for wealth transfer planning

- Continued state estate tax considerations in applicable jurisdictions

- Simplified estate planning for most high-net-worth families

- Reduced compliance costs for estate administration

The increased exemption particularly benefits family business owners and real estate investors whose estates previously faced taxation. However, the provision faces potential sunset in 2025, creating urgency for estate planning decisions.

Taxpayers with estates approaching exemption levels must consider timing strategies and potential law changes in their planning decisions.

Small Business Expensing Benefits

Enhanced Section 179 expensing allows small businesses to immediately deduct up to $1.22 million in equipment purchases during 2025, with the benefit phasing out dollar-for-dollar when purchases exceed $3.05 million. Additional bonus depreciation provisions permit 80% first-year depreciation on eligible property.

Key benefits include:

- Immediate cash flow improvements for equipment purchases

- Simplified depreciation calculations for qualifying assets

- Enhanced competitiveness for small businesses

- Reduced administrative burden for asset tracking

- Improved return on investment for business expansion

Approximately 4.2 million small businesses utilize enhanced expensing provisions annually, with average deductions of $47,000. The provisions particularly benefit:

- Manufacturing companies with equipment needs

- Construction businesses with vehicle and machinery purchases

- Technology companies with computer and software investments

- Professional service firms with office equipment requirements

- Restaurants and retail businesses with fixture installations

The expensing benefits require careful planning to maximize tax advantages while meeting business operational needs.

Filing Status and Dependency Changes

The TCJA maintained existing filing status options while modifying dependency exemption rules. The elimination of personal and dependency exemptions, replaced by enhanced standard deductions and child tax credits, affects tax calculation methods for all taxpayers.

Impact considerations include:

- Simplified calculation for families without complex dependency situations

- Enhanced benefits for families with qualifying children

- Reduced benefits for taxpayers supporting adult dependents

- Modified tax planning strategies for multi-generational households

- Changed divorce decree considerations for dependency claims

The modifications particularly affect:

- Large families with multiple children

- Taxpayers supporting elderly parents or disabled dependents

- Divorced parents with shared custody arrangements

- Extended families with complex household compositions

- International families with foreign dependents

These changes require updated tax planning approaches and careful consideration of dependency qualification requirements.

Professional Tax Preparation Implications

The complexity of TCJA provisions continues to affect tax preparation decisions for millions of taxpayers. While standard deduction increases simplify filing for many, business owners and high-income taxpayers face enhanced complexity requiring professional assistance.

Current trends indicate:

- Increased demand for business tax preparation services

- Growing complexity in multi-state tax situations

- Enhanced need for year-round tax planning

- Rising importance of entity structure decisions

- Continued evolution of tax software capabilities

Tax preparation fees reflect these complexity changes, with business returns and high-income individual returns commanding premium pricing. The Section 199A deduction alone generates significant preparation complexity for affected taxpayers.

Professional tax preparers report increased time requirements for affected returns, particularly those involving multiple business entities or complex income sources.

Future Considerations and Sunset Provisions

Several TCJA provisions face potential expiration after 2025, creating uncertainty for tax planning decisions. The individual tax provisions, including enhanced standard deductions, modified tax brackets, and the Section 199A deduction, require congressional action for extension.

Planning considerations include:

- Potential return to higher tax rates after 2025

- Uncertainty regarding state and local tax deduction limitations

- Possible elimination of Section 199A business deduction

- Estate tax exemption reduction to pre-TCJA levels

- Modified tax planning strategies for transition periods

Taxpayers affected by potential changes should consider:

- Accelerating income recognition strategies

- Timing of major business decisions

- Estate planning acceleration opportunities

- Investment strategy modifications

- Professional consultation for complex situations

The political environment surrounding tax policy creates additional uncertainty requiring flexible planning approaches.

Conclusion

The ongoing impact of Trump’s tax cuts continues to shape taxpayer obligations and opportunities in 2025, with millions of Americans navigating modified tax calculations and planning strategies. The enhanced standard deductions benefit most taxpayers, while business owners face both opportunities and complexity through provisions like the Section 199A deduction.

Understanding these changes remains crucial for effective tax planning and compliance, particularly as sunset provisions create future uncertainty. Taxpayers benefit from reviewing their specific situations annually and adjusting strategies based on changing circumstances and potential law modifications.

The geographic and income-based variations in tax impact ensure that individual analysis remains necessary for optimal tax outcomes. Professional consultation becomes increasingly valuable for taxpayers with complex situations, multiple income sources, or significant business activities.

As tax policy continues evolving, staying informed about current provisions and potential changes enables better financial decision-making and tax efficiency. The 2025 tax filing season will continue reflecting these ongoing impacts while setting the stage for future policy discussions and potential modifications.